Global Finance in Emerging Market Economies: A Comprehensive Guide for Practitioners and Policymakers

Emerging market economies (EMEs) have become increasingly important in the global economy in recent decades. They are now home to a large and growing share of the world's population and economic activity. As a result, the global financial system has become increasingly interconnected with EMEs. This has created both opportunities and challenges for EMEs and the global economy as a whole.

5 out of 5

| Language | : | English |

| File size | : | 2608 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 329 pages |

This book provides a comprehensive overview of global finance in EMEs. It covers a wide range of topics, including the history of EMEs, the different types of financial systems that exist in EMEs, the challenges that EMEs face in developing their financial systems, and the role of international financial institutions in EMEs.

This book is essential reading for practitioners and policymakers working in EMEs. It provides a deep understanding of the global financial system and how it affects EMEs. It also offers practical guidance on how to develop and implement policies that can promote financial development in EMEs.

Chapter 1: The History of Emerging Market Economies

The first chapter of this book provides a brief history of EMEs. It discusses the different factors that have contributed to the emergence of EMEs and the challenges that they have faced over time.

The chapter begins by defining what an EME is. An EME is a country that has a relatively low level of economic development but is experiencing rapid economic growth. EMEs are typically characterized by high levels of poverty and inequality, but they also have the potential for high rates of economic growth.

The chapter then discusses the different factors that have contributed to the emergence of EMEs. These factors include:

* The global economic boom of the 1990s and early 2000s * The rise of China and other emerging economies * The development of new technologies * The liberalization of trade and investment policies

The chapter also discusses the challenges that EMEs have faced over time. These challenges include:

* Financial crises * Political instability * Corruption * Lack of access to finance

Despite the challenges that they have faced, EMEs have continued to grow and develop. They are now home to a large and growing share of the world's population and economic activity.

Chapter 2: The Different Types of Financial Systems in Emerging Market Economies

The second chapter of this book discusses the different types of financial systems that exist in EMEs. It identifies the key features of each type of system and discusses the advantages and disadvantages of each system.

There are three main types of financial systems in EMEs:

* Bank-based financial systems * Market-based financial systems * Mixed financial systems

Bank-based financial systems are characterized by a high level of concentration in the banking sector. A small number of banks control a large share of the financial assets in the country. Bank-based financial systems are often found in countries with a history of financial instability.

Market-based financial systems are characterized by a high level of competition in the financial sector. There are a large number of banks and other financial institutions that compete for customers. Market-based financial systems are often found in countries with a stable political and economic environment.

Mixed financial systems are a combination of bank-based and market-based financial systems. They have features of both types of systems. Mixed financial systems are often found in countries that are in transition from a bank-based financial system to a market-based financial system.

The type of financial system that is best for an EME depends on a number of factors, including the country's level of economic development, the stability of its political and economic environment, and the level of financial literacy of its population.

Chapter 3: The Challenges that Emerging Market Economies Face in Developing Their Financial Systems

The third chapter of this book discusses the challenges that EMEs face in developing their financial systems. These challenges include:

* Financial crises * Political instability * Corruption * Lack of access to finance

Financial crises can have a devastating impact on EMEs. They can lead to a loss of confidence in the financial system, a decline in economic growth, and an increase in poverty. EMEs are particularly vulnerable to financial crises because they often have weak financial systems and high levels of debt.

Political instability can also have a negative impact on the development of financial systems in EMEs. Political instability can lead to a lack of confidence in the government and the financial system. This can make it difficult for businesses to get loans and for investors to invest in the country.

Corruption is another major challenge that EMEs face. Corruption can lead to a misallocation of resources and a loss of confidence in the financial system. This can make it difficult for businesses to get loans and for investors to invest in the country.

Lack of access to finance is a major obstacle to economic development in EMEs. Many businesses and individuals in EMEs do not have access to formal financial services. This can make it difficult for them to get the financing they need to start or grow a business, or to invest in education or healthcare.

Chapter 4: The Role of International Financial Institutions in Emerging Market Economies

The fourth chapter of this book discusses the role of international financial institutions (IFIs) in EMEs. IFIs provide a number of important services to EMEs, including:

* Financial assistance * Technical assistance * Policy advice * Crisis management

Financial assistance is one of the most important services that IFIs provide to EMEs. IFIs can provide loans, grants, and other forms of financial assistance to EMEs. This assistance can help EMEs to stabilize their economies, promote economic growth, and reduce poverty.

Technical assistance is another important service that IFIs provide to EMEs. IFIs can provide technical assistance to EMEs in a number of areas, including:

* Developing and implementing financial sector reforms * Strengthening financial institutions * Improving financial regulation and supervision * Promoting financial inclusion

Policy advice is another important service that IFIs provide to EMEs. IFIs can provide policy advice to EMEs on a wide range of issues, including:

*

5 out of 5

| Language | : | English |

| File size | : | 2608 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 329 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Matthew Schwartz

Matthew Schwartz Kes Gray

Kes Gray Kevin Dibacco

Kevin Dibacco Kathleen Flinn

Kathleen Flinn Kelly Treleaven

Kelly Treleaven Kenneth S Rogoff

Kenneth S Rogoff Kay Wills Wyma

Kay Wills Wyma Kenny Dill

Kenny Dill Kim Gordon

Kim Gordon Kay Laier

Kay Laier Kiki Prottsman

Kiki Prottsman Khadizhat Witt

Khadizhat Witt Ken Conboy

Ken Conboy Praise Daniels

Praise Daniels Kris Holloway

Kris Holloway Kim Barker

Kim Barker Katie Wolf

Katie Wolf Kelle Hampton

Kelle Hampton Ken Xiao

Ken Xiao Sharon Chriscoe

Sharon Chriscoe

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Douglas FosterBillions Selling To The New Chinese Consumer: The Ultimate Guide to Tapping...

Douglas FosterBillions Selling To The New Chinese Consumer: The Ultimate Guide to Tapping...

Ryan FosterCraft Your Own Unique Railroad Spike Knife: A Comprehensive Guide to the Art...

Ryan FosterCraft Your Own Unique Railroad Spike Knife: A Comprehensive Guide to the Art...

Brenton CoxTales of a Female Nomad: Embracing the Courage to Travel Solo and Transform...

Brenton CoxTales of a Female Nomad: Embracing the Courage to Travel Solo and Transform...

Kurt VonnegutUnlocking the Secrets of Motivation: A Comprehensive Guide to Motivational...

Kurt VonnegutUnlocking the Secrets of Motivation: A Comprehensive Guide to Motivational... Jacob FosterFollow ·13.5k

Jacob FosterFollow ·13.5k Amir SimmonsFollow ·11.5k

Amir SimmonsFollow ·11.5k Rex HayesFollow ·15.9k

Rex HayesFollow ·15.9k Hayden MitchellFollow ·16.7k

Hayden MitchellFollow ·16.7k Elton HayesFollow ·15.7k

Elton HayesFollow ·15.7k Allen GinsbergFollow ·11.2k

Allen GinsbergFollow ·11.2k Ralph EllisonFollow ·2.3k

Ralph EllisonFollow ·2.3k Natsume SōsekiFollow ·17.5k

Natsume SōsekiFollow ·17.5k

Joshua Reed

Joshua ReedUnveiling the Profound Essence of Taekwondo: Spirit and...

Taekwondo, an ancient...

Clarence Brooks

Clarence BrooksUnveiling Clarity: The Common Sense Guide to Everyday...

In the labyrinthine world of legal...

Anthony Wells

Anthony WellsBless Me, Ultima: A Literary Odyssey into the Heart of...

In the tapestry of American literature,...

Alexandre Dumas

Alexandre DumasPioneer Life Or Thirty Years A Hunter - A Captivating...

Discover the Raw and...

Samuel Beckett

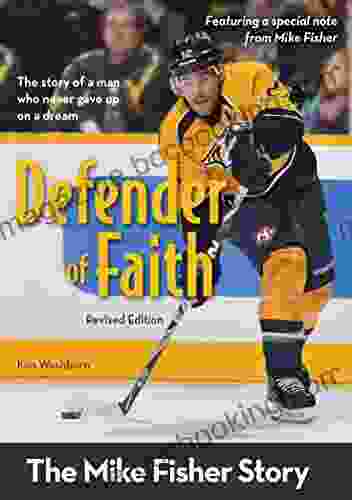

Samuel BeckettThe Mike Fisher Story: An Inspiring Tale of Faith,...

Prepare to be...

5 out of 5

| Language | : | English |

| File size | : | 2608 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 329 pages |