Loss Flood Insurance and the Moral Economy of Climate Change in the United States

As the consequences of climate change become increasingly evident, the United States finds itself grappling with the profound impact of extreme weather events on its citizens and communities. Among these events, flooding poses a particularly devastating threat, wreaking havoc on property, infrastructure, and livelihoods.

4 out of 5

| Language | : | English |

| File size | : | 9101 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 293 pages |

In response to this growing threat, the National Flood Insurance Program (NFIP) was established in 1968 to provide financial assistance to homeowners and businesses in flood-prone areas. However, as climate change intensifies, the NFIP has come under increasing strain, facing significant financial challenges and raising complex moral questions about the distribution of disaster relief and the responsibility of society in mitigating the impacts of climate change.

The Financial Burden of Loss Flood Insurance

The NFIP is a federally subsidized program, and its financial stability has been severely compromised by the rising frequency and severity of flood events. In 2017, Hurricane Harvey alone caused an estimated $125 billion in damage, and the NFIP was forced to borrow billions of dollars from the U.S. Treasury to cover claims.

The financial burden of loss flood insurance is not only borne by the government but also by individual homeowners and businesses. Flood insurance premiums have skyrocketed in recent years, making it increasingly difficult for people in flood-prone areas to afford coverage. This has led to a situation where many homeowners are underinsured or uninsured, leaving them vulnerable to financial ruin in the event of a flood.

The Moral Economy of Climate Change

The financial challenges posed by loss flood insurance raise complex moral questions about the distribution of disaster relief and the responsibility of society in mitigating the impacts of climate change.

On the one hand, there is a strong case to be made for providing financial assistance to victims of natural disasters. Extreme weather events can have a devastating impact on people's lives, and it is only right that society should step in to help those who have been affected.

On the other hand, there is also a need to consider the moral hazard created by disaster relief. When people know that they will be financially compensated for losses incurred in a flood, they may be less inclined to take steps to mitigate the risks. This can lead to a vicious cycle where increasing disaster relief costs lead to higher flood insurance premiums, which in turn leads to more people being underinsured or uninsured.

The Way Forward

Addressing the moral economy of loss flood insurance and climate change requires a comprehensive approach that considers both the financial and ethical dimensions of the issue.

One important step is to invest in flood mitigation measures. By building seawalls, levees, and other flood control structures, we can reduce the risk of flooding and the associated financial burden. This will not only save lives and property but also help to reduce the cost of flood insurance premiums.

Another important step is to reform the NFIP to make it more financially sustainable. This could involve increasing premiums for homeowners in high-risk areas, providing subsidies for low-income households, and exploring alternative funding mechanisms.

Finally, it is essential to address the underlying causes of climate change by reducing greenhouse gas emissions. By transitioning to a clean energy economy, we can help to mitigate the impacts of climate change and reduce the risk of future flooding events.

Loss flood insurance and climate change present a complex and challenging moral economy for the United States. By understanding the financial burdens and moral implications of disaster relief, we can work together to develop a comprehensive approach that ensures that those who are affected by flooding receive the assistance they need while also mitigating the risks and reducing the financial burden for all.

4 out of 5

| Language | : | English |

| File size | : | 9101 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 293 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Louis A Decaro Jr

Louis A Decaro Jr Kevan Houser

Kevan Houser Katherine Roberts

Katherine Roberts Tammie Lyon

Tammie Lyon Yun Rou

Yun Rou Kathy H Kitts

Kathy H Kitts Ken Burns

Ken Burns Nicholas Meyer

Nicholas Meyer Robert M Sapolsky

Robert M Sapolsky Kelly Oram

Kelly Oram Kevin Mcaleer

Kevin Mcaleer Kemi Iwalesin

Kemi Iwalesin Kimberly Dean

Kimberly Dean Margaret Coker

Margaret Coker Violet Kupersmith

Violet Kupersmith Ken Siri

Ken Siri Spike Bucklow

Spike Bucklow Kris Rivenburgh

Kris Rivenburgh Warwick Trucker

Warwick Trucker Susan Rosser

Susan Rosser

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ivan TurnerFollow ·12.8k

Ivan TurnerFollow ·12.8k Calvin FisherFollow ·2.9k

Calvin FisherFollow ·2.9k Chad PriceFollow ·7.8k

Chad PriceFollow ·7.8k Garrett PowellFollow ·17.1k

Garrett PowellFollow ·17.1k Adam HayesFollow ·15.1k

Adam HayesFollow ·15.1k Cameron ReedFollow ·3k

Cameron ReedFollow ·3k Ryūnosuke AkutagawaFollow ·5.3k

Ryūnosuke AkutagawaFollow ·5.3k Guy PowellFollow ·6.3k

Guy PowellFollow ·6.3k

Joshua Reed

Joshua ReedUnveiling the Profound Essence of Taekwondo: Spirit and...

Taekwondo, an ancient...

Clarence Brooks

Clarence BrooksUnveiling Clarity: The Common Sense Guide to Everyday...

In the labyrinthine world of legal...

Anthony Wells

Anthony WellsBless Me, Ultima: A Literary Odyssey into the Heart of...

In the tapestry of American literature,...

Alexandre Dumas

Alexandre DumasPioneer Life Or Thirty Years A Hunter - A Captivating...

Discover the Raw and...

Samuel Beckett

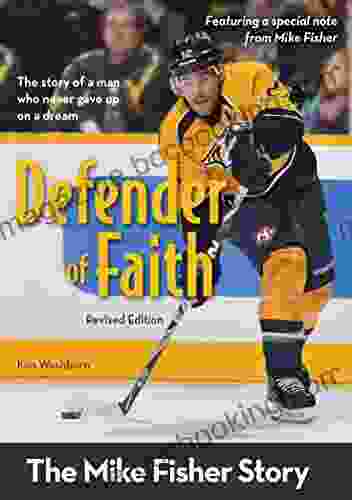

Samuel BeckettThe Mike Fisher Story: An Inspiring Tale of Faith,...

Prepare to be...

4 out of 5

| Language | : | English |

| File size | : | 9101 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 293 pages |