Tax Haven Ireland: The Complete Guide to Ireland's Tax System and Its Role in the Global Economy

5 out of 5

| Language | : | English |

| File size | : | 1424 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |

Ireland has been a popular tax haven for decades. Its low corporate tax rate of 12.5% has attracted businesses from all over the world. In addition, Ireland has a number of other tax advantages, such as a territorial tax system and a wide network of double tax treaties.

Kieran Allen's book, Tax Haven Ireland, provides a comprehensive overview of the country's tax system and its role in the global economy. The book is divided into three parts. The first part provides a general overview of Ireland's tax system, including its history, structure, and administration. The second part examines Ireland's role as a tax haven, focusing on the country's low corporate tax rate and its network of double tax treaties. The third part discusses the impact of Ireland's tax haven status on the global economy, including the country's role in tax avoidance and tax evasion.

Tax Haven Ireland is a valuable resource for anyone interested in Ireland's tax system or its role in the global economy. The book is written in a clear and concise style, and it is well-organized and easy to follow. Allen provides a comprehensive overview of the topic, and he does not shy away from discussing the controversial aspects of Ireland's tax haven status.

The History of Ireland's Tax Haven Status

Ireland has been a tax haven since the 1950s. The country's low corporate tax rate was introduced in 1956, and it has been a major factor in attracting foreign investment to Ireland. In addition, Ireland has a number of other tax advantages, such as a territorial tax system and a wide network of double tax treaties.

Ireland's tax haven status has been controversial. Critics argue that the country's low corporate tax rate allows multinational corporations to avoid paying their fair share of taxes. They also argue that Ireland's territorial tax system allows companies to shift their profits to low-tax jurisdictions.

Defenders of Ireland's tax haven status argue that the country's low corporate tax rate has helped to attract foreign investment and create jobs. They also argue that Ireland's territorial tax system is in line with international norms.

The Impact of Ireland's Tax Haven Status on the Global Economy

Ireland's tax haven status has a significant impact on the global economy. The country's low corporate tax rate has led to tax avoidance and tax evasion on a global scale. In addition, Ireland's territorial tax system allows companies to shift their profits to low-tax jurisdictions, which has led to a loss of tax revenue for other countries.

The OECD estimates that tax avoidance costs governments around the world $240 billion each year. Ireland is one of the largest contributors to this problem. In 2014, the Irish government collected just €11 billion in corporate tax revenue, even though the country's GDP was €249 billion.

The loss of tax revenue due to tax avoidance and tax evasion has a number of negative consequences. It can lead to cuts in public services, higher taxes for other taxpayers, and a decline in economic growth.

Ireland's tax haven status is a controversial issue. Critics argue that the country's low corporate tax rate allows multinational corporations to avoid paying their fair share of taxes. They also argue that Ireland's territorial tax system allows companies to shift their profits to low-tax jurisdictions.

Defenders of Ireland's tax haven status argue that the country's low corporate tax rate has helped to attract foreign investment and create jobs. They also argue that Ireland's territorial tax system is in line with international norms.

The impact of Ireland's tax haven status on the global economy is significant. The country's low corporate tax rate has led to tax avoidance and tax evasion on a global scale. In addition, Ireland's territorial tax system allows companies to shift their profits to low-tax jurisdictions, which has led to a loss of tax revenue for other countries.

The loss of tax revenue due to tax avoidance and tax evasion has a number of negative consequences. It can lead to cuts in public services, higher taxes for other taxpayers, and a decline in economic growth.

Kieran Allen's book, Tax Haven Ireland, provides a comprehensive overview of the country's tax system and its role in the global economy. The book is a valuable resource for anyone interested in Ireland's tax system or its role in the global economy.

To learn more about Ireland's tax haven status, please visit the following resources:

- OECD: Tax Avoidance and Evasion

- Irish Times: Ireland loses €11bn in tax revenue annually due to profit shifting

- Tax Justice Network: Ireland: A Haven for Tax Dodgers

5 out of 5

| Language | : | English |

| File size | : | 1424 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Tim Leong

Tim Leong Nicholeen Peck

Nicholeen Peck Kim Culbertson

Kim Culbertson Kathleen Rooney

Kathleen Rooney Kevin Savetz

Kevin Savetz Maude Barlow

Maude Barlow Kyle Chayka

Kyle Chayka Kevin Griffis

Kevin Griffis Kenny Salwey

Kenny Salwey Kerry Diamond

Kerry Diamond Ken Mcnab

Ken Mcnab Katy Duffield

Katy Duffield Rachel Cruze

Rachel Cruze Kathy Fray

Kathy Fray Kevin Brennan

Kevin Brennan Katrina Lawrence

Katrina Lawrence Kidsup Publishing

Kidsup Publishing Nicholas Tana

Nicholas Tana Kiley Reid

Kiley Reid Keir Cutler

Keir Cutler

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Robbie CarterOne Sip at a Time: A Literary Masterpiece That Will Quench Your Thirst for...

Robbie CarterOne Sip at a Time: A Literary Masterpiece That Will Quench Your Thirst for...

Joel MitchellExplore the Great Northern Frontier: Uncover the Enchanting Landscapes and...

Joel MitchellExplore the Great Northern Frontier: Uncover the Enchanting Landscapes and... Felipe BlairFollow ·2.6k

Felipe BlairFollow ·2.6k Branden SimmonsFollow ·2.1k

Branden SimmonsFollow ·2.1k Milton BellFollow ·11.4k

Milton BellFollow ·11.4k Robert FrostFollow ·14.7k

Robert FrostFollow ·14.7k Ethan GrayFollow ·18.7k

Ethan GrayFollow ·18.7k Garrett PowellFollow ·17.1k

Garrett PowellFollow ·17.1k John KeatsFollow ·13k

John KeatsFollow ·13k Edward ReedFollow ·4.8k

Edward ReedFollow ·4.8k

Joshua Reed

Joshua ReedUnveiling the Profound Essence of Taekwondo: Spirit and...

Taekwondo, an ancient...

Clarence Brooks

Clarence BrooksUnveiling Clarity: The Common Sense Guide to Everyday...

In the labyrinthine world of legal...

Anthony Wells

Anthony WellsBless Me, Ultima: A Literary Odyssey into the Heart of...

In the tapestry of American literature,...

Alexandre Dumas

Alexandre DumasPioneer Life Or Thirty Years A Hunter - A Captivating...

Discover the Raw and...

Samuel Beckett

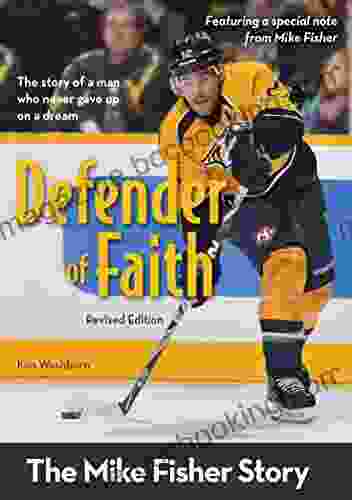

Samuel BeckettThe Mike Fisher Story: An Inspiring Tale of Faith,...

Prepare to be...

5 out of 5

| Language | : | English |

| File size | : | 1424 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |